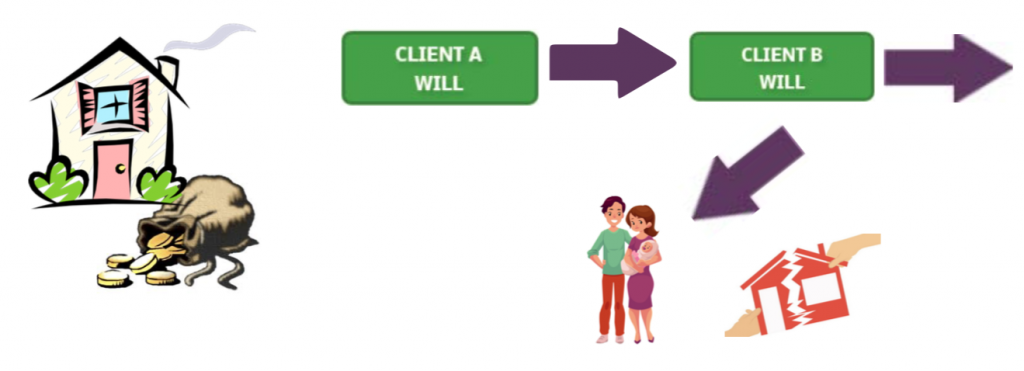

Typical Existing Planning

- The home and savings are typically left to each other, and then left to the children directly.

- If the surviving partner remarries, the children’s inheritance is at risk. This is known as ‘Sideways Disinheritance’.

- If the children are married and get divorced, these assets will be part of the divorce settlement.

Where there is no will, or couples have only a basic will/mirror wills in place, your assets are exposed to the following risks:

- Creditors or Bankruptcy If the surviving spouse/partner were to be subject to Creditor Claims/Bankruptcy then the inherited estate is fully at risk.

- Marriage After Death (MAD) On first death all the assets are then solely owned by the surviving spouse partner. What if the surviving spouse/partner marries? The inherited estate could be lost to the spouse, disinheriting your children.

On second death there are further risks to the estate you wished your loved ones to benefit from:

- Divorce If your children/chosen Beneficiaries are subject to Divorce proceedings then half of what you intended them to receive is at risk of Divorce settlements.

- Their own future Care Costs If the inheritance has been passed to your chosen Beneficiaries, these assets could later be assessed for their own Care Costs.

- Generational Inheritance Tax IHT On second death the remaining estate is likely to be directed by the Will to the Beneficiaries. This then adds to the Beneficiaries’ estates and could impact their own Inheritance Tax

- Creditors or Bankruptcy Similarly, if any of your Beneficiaries are subject to Creditor Claims/Bankruptcy then the inherited estate is fully at risk.

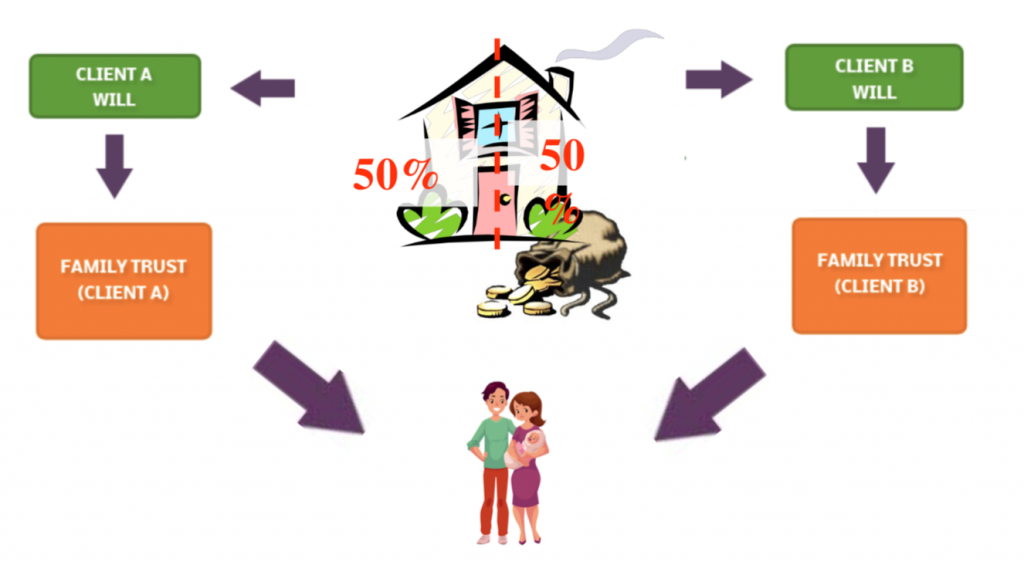

Our Solution

- On first death, the deceased’s share of the property and savings are passed into their Family Trust via their Will.

- The surviving partner is able to enjoy the full use of these assets – live in the home and have use of the savings.

- On the second partner’s death their assets are settled into a second Family Trust via their Will.

- The chosen beneficiaries (typically children or grandchildren – your blood relatives) will be able to have full use of these assets but they will be ring fenced from a number of potential future threats.

The beneficiaries have the full benefit of the Trust assets, but it does not enter their estate.

They are also protected from the following:

- Care Holding the assets in the Trust ensures that they do not add onto the Beneficiaries’ own estates and so cannot be assessed for their Care costs.

- Creditors or Bankruptcy Similarly, if any of your Beneficiaries are subject to Creditor Claims/Bankruptcy then their inheritance would not be exposed to these claims.

- Further or Generation Inheritance Tax (IHT) Holding the assets in the Trust ensures that they do not add to the Beneficiaries’ estates and impact on their own Inheritance Tax.

- Marriage After Death (MAD) Placing half of the family home and other assets into a Trust on first death ensures that, should the surviving spouse/partner marry in the future, those assets cannot be taken into the marriage and removes the threat of your own children being disinherited.

- Divorce Placing the assets into Trust ensures that, if your children/ chosen Beneficiaries are subject to Divorce proceedings then what you intended them to receive is protected from any Divorce settlements.

- Residence Nil Rate Band (RNRB) Our trusts ensure that if there are lineal descendants as beneficiaries, the trust will still qualify for the RNRB.

When assets are simply passed to beneficiaries “absolutely”, (i.e. they receive cash, property or other assets as a direct lump sum payment) so much can be lost. These assets are then considered to be part of the beneficiary’s estate and would be at risk of attack from any future divorce settlements, creditors and taxation.

Use of Trusts are an extremely effective way allow your partner, children and grandchildren to benefit completely from the inheritance that you want them to receive, whilst protecting the family home and other assets from impacts such as bankruptcy, divorce or being lost to Long Term Care. Trusts are extremely flexible in that they can allow assets to be controlled through the generations, providing clear direction, and crucially, ensuring that the assets stay within the bloodline.